Table of Contents

mihailomilovanovic/E+ via Getty Images

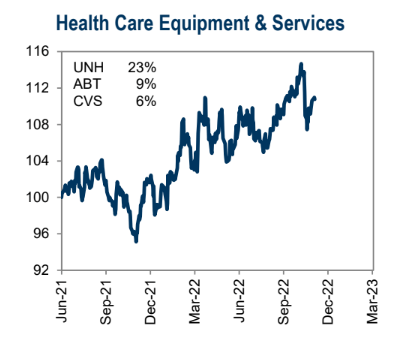

Health Care supplies stocks have generally been in favor over the last year. The group, led by UnitedHealthcare (UNH), Abbott Laboratories (ABT), and CVS (CVS) has trended up against the broad market. But it’s a diverse group with many smaller players in riskier niches. One domestic name was an unexpected pandemic winner, but now faces executive shifts at the top along with struggling bottom-line profits.

Health Care Equipment Names With Relative Strength

Goldman Sachs Investment Research

According to Bank of America Global Research, Dentsply Sirona (NASDAQ:XRAY) is one of the world’s largest dental manufacturers, providing dental offices with total solutions ranging from consumables to high-end equipment. The company has operations in over 120 countries. It operates through two segments, Technologies & Equipment, and Consumables.

The North Carolina-based $6.5 billion market cap Health Care Equipment & Supplies industry company within the Health Care sector has negative GAAP earnings over the past 12 months and pays a 1.7% dividend yield, according to The Wall Street Journal.

Shares were on the move higher in mid-November when some activist investor chatter made the rounds, but those gains proved temporary within a broader downtrend. Also happening during the middle of last month was an important EPS miss in XRAY’s Q3 report. The firm also fell short on revenue forecasts.

Dentsply Sirona has a volatile earnings history with its large multinational presence. There are headwinds from macro issues like FX along with uncertainty surrounding recent CEO and CFO changes. Still, there is some cushion seen in its somewhat stable portfolio of dental manufacturing activities. Downside risks include a slowdown in global growth and possible lagging equipment sales following Covid. Upside potential stems from positive sales initiatives after the launch of Primescan and other products.

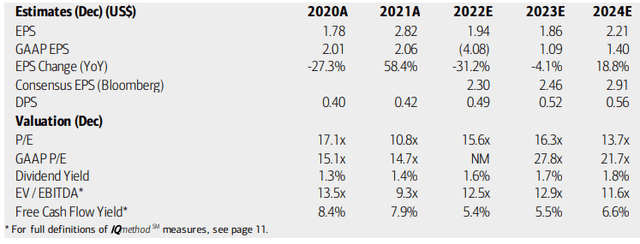

On valuation, analysts at BofA see earnings having fallen sharply this year and dropping again in 2023, though at a more modest rate. The Bloomberg consensus forecast is more upbeat on both total operating earnings per share and the growth trajectory. Dividends meanwhile are expected to rise, though the yield will stay under 2% it appears.

XRAY has a near-market forward non-GAAP P/E while its GAAP P/E is much higher using forward estimates. The good news is that the firm is free cash flow positive, but the EV/EBITDA multiple is not particularly attractive given uncertain growth. Overall, I am not convinced this is a solid value story right now.

Dentsply Sirona: Earnings, Valuation, Free Cash Flow Forecasts

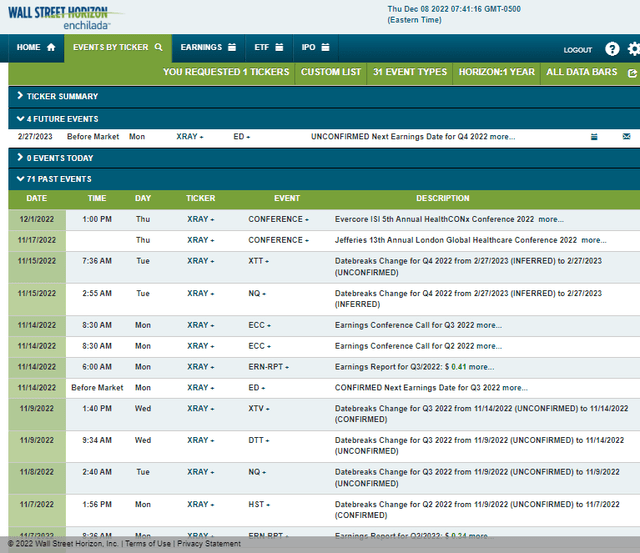

Looking ahead, corporate event data from Wall Street Horizon show an unconfirmed Q3 2022 earnings date of Monday, February 27 before market open. The firm recently spoke at a pair of conferences, but those events did not do much to help the stock price.

Corporate Event Calendar

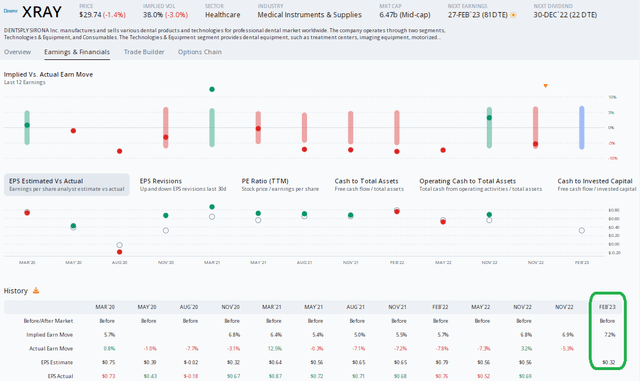

Digging into the upcoming earnings report, data from Option Research & Technology Services (ORATS) shows an expected per-share profit figure of $0.32 which would be a sharp decline from $0.76 of EPS seen in the same quarter a year ago. Implied volatility is not exceptionally high right now, near 38%, so do not expect big moves in the stock price any time soon.

Earnings Growth Expected to be Negative YoY

The Technical Take

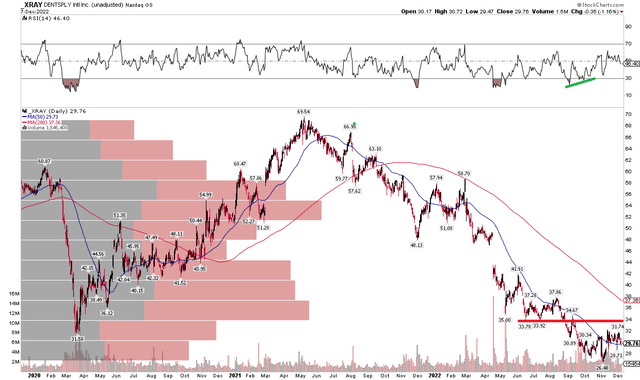

XRAY was a big winner coming out of the pandemic with the stock rising from near $30 to almost $70 by Q2 2021. The last year-and-a-half has been a downward ride, though. I see some possible signs of a slowdown in bearish momentum, as evidenced by an improved RSI at the top of the chart, but with a pronounced downtrend in place and resistance near $32 and $34, along with a downward-sloping 200-day moving average, the trend is too hard to fight on this health care name.

XRAY: A Protracted Downtrend

The Bottom Line

XRAY’s uncertain earnings outlook, lukewarm valuation, and bearish price trend make me a seller right now. We need to see evidence of better operating results along with a reversal on the chart.

More Stories

United Healthcare’s ransomware attack shows why supply chains are under siege

Nutrition Tips For Ramadan | JM Nutrition

Probiotics for IBS | The Nutritionist Reviews