Most Chattanoogans who do not have overall health insurance by their employer, Medicare or TennCare will be having to pay greater premiums upcoming 12 months to purchase specific insurance plan programs via the overall health trade market.

But as indication-ups for 2023 coverage start off this 7 days, individuals will have additional choices and are extra most likely to qualify for authorities assistance with their well being options.

The Tennessee Section of Commerce and Insurance policies has permitted 6 insurers for specific insurance policies presented by the Inexpensive Care Act wellbeing trade for 2023, including 4 in Chattanooga. Bright Overall health is exiting the unique and family members current market in Tennessee at the end of the 12 months, although Ascension Personalised Treatment/US Health and fitness and Daily life has joined the Tennessee trade for 2023.

On common, insurers ended up granted fee increases averaging 8.5% for future yr, which is nearly double the common 4.4% authorized by point out regulators for options in 2022.

Most shoppers ought to be ready to offset some or all of the enhance by searching about for other strategies or using benefit of some more authorities assist, however.

In the course of the pandemic, subsidies for designs supplied as a result of the Inexpensive Treatment Act were expanded, and Congress locked in the improved subsidies via 2025 under the Inflation Reduction Act. The Facilities for Medicare and Medicaid Companies estimates 4 out of five consumers on Healthcare.gov will be equipped to discover a strategy for $10 a thirty day period or significantly less soon after subsidies.

The new “family glitch” modify will allow for much more individuals to be qualified for subsidies who ended up not eligible in the earlier. In the previous, numerous Americans ended up pressured to purchase additional highly-priced family or personal ideas with no any subsidies mainly because their spouse had wellness insurance policy by means of function even if they couldn’t manage to add a husband or wife or small children to the prepare. The City Institute estimates that by extending subsidies to all those unable to afford or get obtain to their spouse’s protection at operate could assist up to 125,000 Tennesseans, or 2.2% of the nonelderly inhabitants.

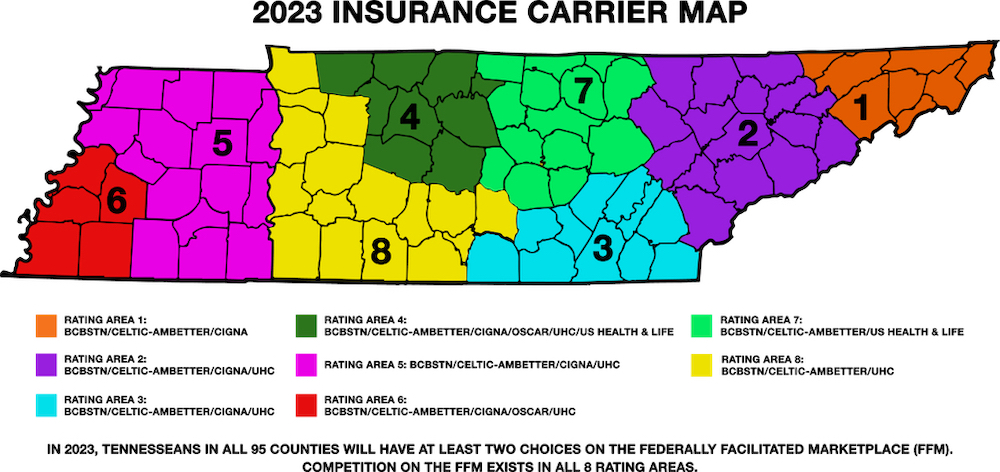

Contributed picture / Map of Tennessee insurance policy carriers in the health and fitness trade marketplace for 2023.

“This is a adjust that need to assistance a good deal of men and women,” Bobby Huffaker, founder of the Chattanooga-dependent American Trade, claimed in a telephone job interview. “Rates are going up, but in most instances, govt subsidies must keep plans fairly very affordable.”

American Trade aids shoppers indicator up for specific health strategies in 47 states. For the 2023 open up enrollment interval, American Exchange has employed 17 extra personnel to support people navigate Affordable Treatment Act and Medicare open up enrollments, which started Tuesday for following year’s coverage.

“In 2023, the innovative tax credits that cut down consumer rates are better because of to the extension of the COVID emergency degree subsidies, which were prolonged by 2025, so options are pretty cost-effective in the increased Chattanooga place,” Andrew Hetzler, CEO of American Trade, said in an email.

People will have at minimum two insurance policy selections for particular person health and fitness treatment strategies by way of the exchange software in all 95 Tennessee counties. One particular insurance policy carrier has also expanded its coverage place for 2023.

In accordance to investigate by the Kaiser Relatives Basis, 14.5 million Individuals, which includes 273,680 in Tennessee and 701,135 in Georgia, have enrolled in one particular of the market exchange systems presented less than the Reasonably priced Treatment Act, also known as Obamacare, all through the previous five yrs.

Despite Republican phone calls in the previous to repeal Obamacare, Michele Johnson of the Tenser Justice Middle stated political opposition to the federal method has weakened around time.

“Obamacare is here to stay for the reason that men and women see how it has served so numerous people get needed well being treatment protection at an economical charge,” she said in a cellular phone job interview.

Johnson explained she is dissatisfied Tennessee didn’t extend its TennCare application to incorporate extra Tennesseans as other states have completed with expanded Medicaid programs.

In 2021, the number of Americans coated by overall health insurance from their employer totaled about 156 million, or 49% of the country’s population. The common yearly quality for employer-sponsored wellness insurance policy is around $7,739 for an unique and $22,221 for a spouse and children, in accordance to the Kaiser Loved ones Foundation.

Whilst the Inexpensive Treatment Act requires businesses with a lot more than 50 staff to give health and fitness coverage for their workers or spend a penalty to the IRS, almost a 3rd of full-time staff in Tennessee are nevertheless not protected by overall health insurance policy since they operate for smaller companies. Only 28.4% of element-time staff have employer-sponsored overall health insurance policy, according to the Kaiser Spouse and children Basis.

“Inflation is hitting a good deal of family members and generating a genuine will need for aid in spending expenditures of all types, which includes wellbeing insurance,” Johnson explained.

BlueCross BlueShield of Tennessee, the state’s most significant overall health insurer, attained acceptance from state regulators in August for a 6.4% raise in its top quality costs for the well being exchange method. But in Chattanooga, BlueCross doubled its offerings for 2023 with 16 distinctive system alternatives, together with 7 Bronze, 7 Silver and two Gold plans. This calendar year, BlueCross offered 4 Bronze, a few Silver and a person gold approach.

“Because some of our new 2023 ideas strike decrease price tag factors, present consumers might choose to swap and offset some of the charge change,” BlueCross spokeswoman Alison Sexter claimed in an emailed statement. “We know affordability matters to our members, so we’re happy we can offer you more competitive fees future 12 months.”

Just before enrolling in any strategy, point out insurance policy officers advise:

— Assessment each plan to be certain it gives the coverage for companies you are trying to get or could will need in the coming year. While it may perhaps be tempting to enroll in a approach with the cheapest premium, shoppers must acquire into account other prospective fees these as co-pays and deductibles.

— Request queries and contact the carriers about their ideas. People can understand extra facts about person options and look at a map of coverage carriers’ places by checking out the site for the Tennessee Department of Commerce and Insurance policies.

— Analysis premiums, deductibles, co-pays and price tag-sharing together with examining each and every insurance coverage carrier’s networks for their most available and/or desired suppliers and hospitals. Buyers should often go to in-community vendors to steer clear of significant expenses. The health coverage corporation can give a record of in-network providers in the vicinity of you.

A lot more information and facts is available by calling 1-800-318-2596 or viewing Healthcare.gov.

Get in touch with Dave Flessner at [email protected] or 423-757-6340. Stick to him on Twitter @DFlessner1.

2023 charge raises

The five wellbeing insurers that are the moment all over again supplying wellbeing care protection in Tennessee upcoming 12 months are boosting their premiums in 2023 by extra than the typical 4.4% increase built a calendar year back. The insurers offering insurance on Healthcare.gov and their permitted rate variations up coming yr are:

* BlueCross BlueShield of Tennessee: 6.43% increase

* Cigna: 9.9% enhance

* Celtic/Ambetter: 5.8% maximize

* Oscar: 5.8% improve

* UHC: 11.35% improve

* US Wellness: New entrant to the marketplace

Source: Tennessee Division of Commerce and Coverage

More Stories

Ashwagandha’s Impact on Cortisol Levels in Stressed People

Health care cyberattack ‘likely one of the worst,’ expert says

Accessing Medicinal Cannabis in the UK: A Comprehensive Guide